Ad Code

Translate

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Smart strategies for trading on crypto exchanges

October 20, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

Discover Honeybee Pharmacy (2025 Guide Important Consumer Tips)

October 14, 2025

Posture Bra: Improving Back Support and Comfort

October 20, 2025

How To Find Suitable Properties In Cyprus?

October 20, 2025

10 Effective Strategies to Improve Domain Authority of Your Website

October 20, 2025

PayPal in South Africa: How to link PayPal to FNB

Khabza Mkhize

August 17, 2023

Withdrawing money from PayPal to South Africa is the bread and butter of many online entrepreneurs and shopaholics. We are deep in the age of connectivity, and if you have even a passing interest in making money online, you are bound to cross paths with PayPal. Whether for shopping or accepting and making payments, PayPal allows you to transact globally without putting sensitive information like credit card details at risk.

Payoneer is another service similar to PayPal that allows you to draw your funds from abroad. It is equally good to PayPal and is not tied to a specific bank, so if you are looking for an alternative to PayPal, you can create a Payoneer account to pay to make payments to people abroad and for services like Amazon or Upwork that use Payoneer to pay out.

PayPal in South Africa

While PayPal has been around for two decades, in South Africa, we have only been able to use it to receive money in local accounts since 2010, thanks to FNB. Even so, it still needs to be widely used, and if you get stuck in setting it up, information on how to set it up needs to be updated or updated.There is an official FNB Guide on how to get set up, but it does not include some of the critical steps in enough detail and can be confusing, especially if you aren’t technically inclined, so I wrote this guide to help with some of the points I found confusing.

The guide is written in the same layout as the official guide, covering each step in better and more excellent to help with the parts. Otherwise, you can just watch the video below and follow it.

Step 1: Verified PayPal Account.

To create a PayPal account, you need an email that your account will be based on, along with a credit card or debit card. To link your PayPal account to FNB and draw money from me,t, the PayPal Account has to be verified; you will need a debit or credit card. PayPal accepts several types of cards, which are listed on the website. For South African cards, you generally need a card with a Visa or MasterCard logo.When you have followed the steps for verification, PayPal will conduct a small transaction (under $2) on your card to authenticate your banking details. The transaction will be reversed, and you will get your money back. This takes up to 24 hours, so you can wait until the next day to resume. When the process completes, you will get an email from PayPal confirming that your account has been verified.

Step 2: Create an FNB online profile

This step is required for general online transacting and is simple. You will need to go to sign up on the FNB website (link). And create an online profile with your email address. You need KYC (Know Your Customer) documents, such as ID and Proof of Residence, that you will email or fax to FNB. If you use the FNB app, you will also need your phone on hand to complete the 2-Factor Authentication (when your phone asks you to okay transactions done on another device).You don’t need to be an FNB customer to open a profile, so if you bank with a different bank, you can still go ahead and create a profile and link to the PayPal profile to an accepted card from any of the other South African banks. The FNB online platform will allow you to link a non-FNB card and withdraw money from your PayPal account to Nedbank, Absa, Standard Bank, and Capitec accounts.

How To Register For PayPal as Non-FNB CustomerGo to www.fnb.co.za

Click “” Register” at the top to the left of the username field.

Choose “Register for PayPal for non-FNB Customers.”

From there, just fill in the rest of your information, and you can create an FNB profile as a non-FNB customer.Step 3: Linking of PayPal to FNB Account

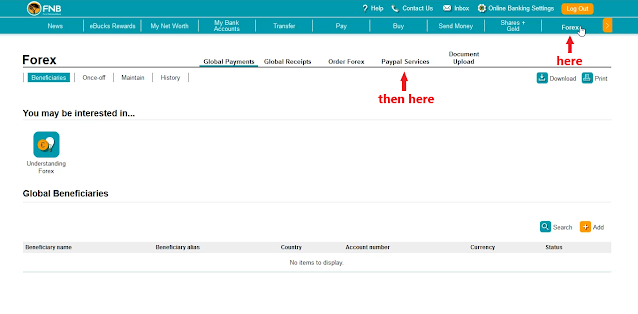

You can link your account now that you have everything you need in the setup process. This is where things can get confusing as some of the options on the FNB website can be difficult to find, so I have added pictures showing the particular steps where I get stuck.

Log in to your FNB Profile

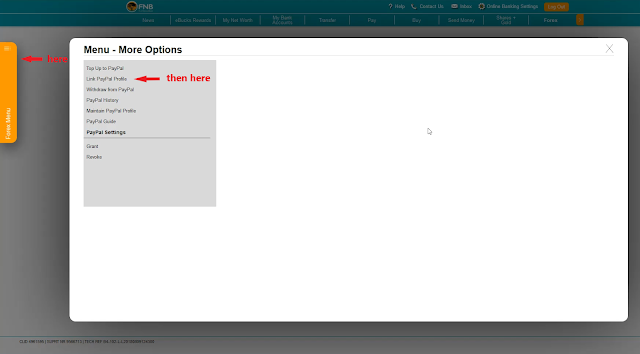

Select the Menu option and then select Link to Paypal.

This is the step where I got stuck because I needed help finding the menu option, which is placed in an unintuitive place for a step-by-step process. It is located in the orange tab to the left of the screen and opens up to a list of draw-down options. When you click the orange bill, the list of options should appear where you will find the “Link to PayPal” option.The linking consists of a three-step process of filling in the information about your FNB and PayPal Account details.

Fill or confirm your personal details as an existing FNB Customer.

Authorizing the linking of the account from PayPal. This step will link out of FNB to your PayPal account and need you to sign in to do the authorization.

Follow the instructions and complete all the necessary information to link your account. As soon as it is connected, you will receive an email confirmation.

Sometimes this option does not show; if not, it might be because you still need to grant FNB access to your PayPal balance.

To give FNB access, you can choose to link out of FNB, requiring you to sign in to your PayPal account and allow access to your balance.

Step 4: Transact with your PayPal

Congratulations! You have now linked your PayPal to FNB. You can now top up your PayPal account to pay shop at global marketplaces such as Amazon or to pay people, as well as receive payments from abroad and withdraw the money from PayPal to your South African bank account.Things to remember: mindDrawing money from PayPal to FNB takes 3 to 6 business days to process. From my experience, the average is closer to the full 6 days, so if you draw money from your PayPal account, it is safest to expect to get it in your account the following week. Cash in your PayPal account must be withdrawn within 30 days of being deposited into the PayPal account.FNB prescribes that you cannot use money paid in your PayPal account to conduct transactions other than withdrawals. You cannot use money paid into your PayPal account to shop with or pay other people; you can only withdraw it. If you want to pay somebody through PayPal or for online shopping using PayPal, you have to top up your PayPal account with money already in your bank account. Remember to consider the tax liability and ensure compliance with all the money you receive through PayPal. FNB must report all transactions from PayPal to South Africa to SARS, so you should ensure compliance if you exceed the tax threshold. Freelancers and business people should already, but it is easy to forget when new to global transacting.

Error Issues and Solutions

Grant permission error on PayPal settings in my FNB online banking app

I cannot grant permission under the Paypal settings on my FNB online banking app; please assist me! It keeps saying error when I try to grant permission!Solution

Login to PayPal, and Go to Settings. Check how many email addresses you have. If you have two email addresses remove another one. FNB no longer support multiple email address.

Featured Post

DL Mining Launches Ethereum Contract Participation Service, Helping Users Earn $2K Stable Daily Returns

Zizo Gala-Mkhize-

October 20, 2025

Soapie Teasers

Sister Sites

Most Popular

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

Popular posts

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

How To Choose The Right Place For A Winter Campsite

March 06, 2023

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Footer Menu Widget

Created By Blogspot Theme | Distributed By Gooyaabi Templates

Social Plugin