Ad Code

Translate

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Smart strategies for trading on crypto exchanges

October 20, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

Discover Honeybee Pharmacy (2025 Guide Important Consumer Tips)

October 14, 2025

Posture Bra: Improving Back Support and Comfort

October 20, 2025

How To Find Suitable Properties In Cyprus?

October 20, 2025

10 Effective Strategies to Improve Domain Authority of Your Website

October 20, 2025

The Reason Why Debt Consolidation Loan Is a Boon for Young Professionals and Students

Khabza Mkhize

March 20, 2023

The education expenses are spiraling day by day. Unless your parents did the right job of saving enough for your higher education, you would require taking vast amounts of loans to pursue higher studies. Depending on the kind of course and your academic performance, you could avail of student loans with different interest rates, tenures, and collateral. Generally, you could start the loan repayment process once you have completed your higher education and taken up a good job.

Problems That You Encounter

It is critical tackling financial issues, particularly when you are already burdened with a substantial student loan that you need to repay. As most first-time jobs pay an average salary, most young professionals spend a significant amount of their monthly compensation to pay off debts. That leaves them with very little money to buy basic foodstuff, pay rent, utilities, and some lifestyle-oriented expenses. Therefore, most young professionals are compelled to take personal loans and credit cards to pay their bills.

This becomes a habit, and they take loans out of sheer desperation. You would be compelled to take out multiple loans. The challenge would be to keep aside adequate monthly money for loan repayments. You need to keep up with the deadlines, keep tracking the changes in interest rates and complete the paperwork related to all those loans. Get in touch with a professional company for intelligent solutions.

The Right Solution

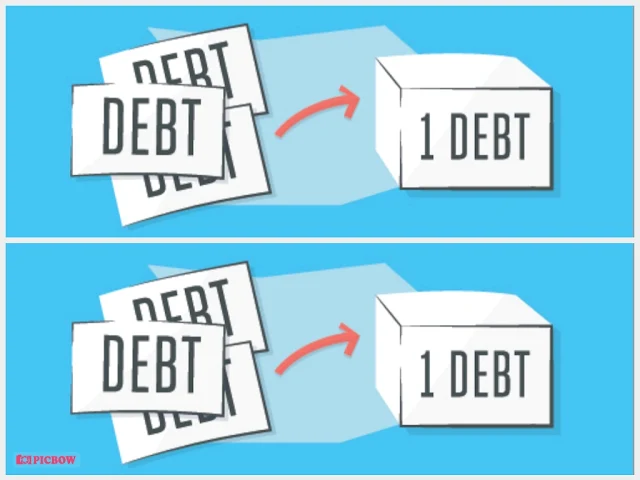

As a budding professional, you must have many goals and aspirations. You simply cannot compromise your dreams by getting unnecessarily bogged down by loans. Experts believe that outstanding debts are one of the significant causes of worry and tension in young professionals. Under those circumstances, a debt consolidation loan is the right choice that effectively reduces your stress and anxiety. When you opt for debt consolidation, you would be consolidating multiple smaller loans and winning the much-desired liberty to handle only one line of credit, one creditor, and only one monthly payment.

Conclusion: Be Cautious

Many crucial factors would determine if debt consolidation would work effectively for you. Before approaching a professional debt consolidation agency, you must talk to a financial advisor who can guide you along the right path toward freedom from debts. If the advisor suggests that debt consolidation is the best choice for your situation, you may seek assistance from a legitimate and reputed debt consolidation company. They would be helping you with the complete documentation and paperwork.

Different from conventional lending institutions, which would determine your eligibility for the debt consolidation loan by examining your credit report, the debt consolidation companies know that you are already neck deep in debt and, obviously, you cannot generate a shining credit history. Debt consolidation could be your path to freedom from the present financial mess, and gradually, you could boost your credit score. You must examine the viability of the debt consolidation loan, but for this loan to spell wonders, you need to stop splurging and work towards a secure financial position.

Featured Post

DL Mining Launches Ethereum Contract Participation Service, Helping Users Earn $2K Stable Daily Returns

Zizo Gala-Mkhize-

October 20, 2025

Soapie Teasers

Sister Sites

Most Popular

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

A Wood-Burning Stove in a Tent: A Guide to Safe Hot Tenting

April 08, 2021

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Popular posts

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

A Wood-Burning Stove in a Tent: A Guide to Safe Hot Tenting

April 08, 2021

Footer Menu Widget

Created By Blogspot Theme | Distributed By Gooyaabi Templates

Social Plugin