Ad Code

Translate

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Smart strategies for trading on crypto exchanges

October 20, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

Discover Honeybee Pharmacy (2025 Guide Important Consumer Tips)

October 14, 2025

Posture Bra: Improving Back Support and Comfort

October 20, 2025

How To Find Suitable Properties In Cyprus?

October 20, 2025

10 Effective Strategies to Improve Domain Authority of Your Website

October 20, 2025

How Can Businesses Ensure Reliable Online Payment Processors?

Zizo Gala-Mkhize

April 10, 2025

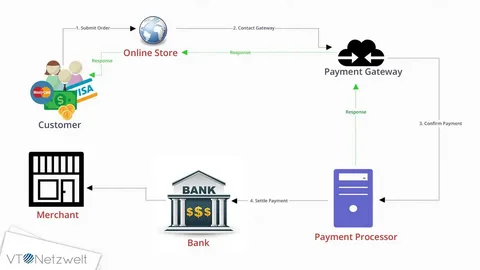

Payment gateways facilitate money transfers between customers and merchants by securely transmitting transaction information to banks. Data transmitted from the customer to the retailer to the processor is encrypted by payment gateways. Online purchases result in payments being made online. The rise of online transactions has led businesses to turn to payment gateways. Customers benefit from payment gateways because they simplify the checkout process and reduce fraud. Due to the absence of credit card processing fees, payment gateway solutions can further reduce costs. There is nothing complicated about the process. Despite this, there are also risks involved. To protect yourself against fraudulent purchases, you should implement acuitytec risk management.

What Is Payment Gateway?

A payment gateway is a service that allows online merchants to process customer payments. This means the merchant no longer needs to worry about processing or maintaining a payment processing system. Instead, the payment gateway handles all the technical details so the merchant can focus on running their business. Payment gateways come in many forms, but an eCommerce platform is the most common. This platform allows merchants to manage their customer data and checkout processes in one place. It provides a secure and efficient way for customers to make payment transactions. Payment Gateway also allows businesses to extend their reach by accepting payments from other companies. The payment gateway also provides tracking and reporting capabilities so businesses can understand how payment processing affects their business.

This means that the business can quickly receive customer payments and keep track of their transactions. The newest form is cryptocurrency payment gateway which is now available for businesses to receive crypto payments.

How are payment gateways operated?

A payment gateway is a software or hardware device that allows consumers to make payments using their credit cards, debit cards, or other financial instruments. The gateway accepts these payments and passes the money on to the merchants who accept the payment. Payment gateways are essential because they allow businesses to accept customer payments without setting up their own payment processing systems. When a payment gateway conducts your transaction, it compares the data you provided to their policy requirements. They will refuse your order and email you if they discover that using your card or bank account on their website is prohibited. They make it possible for internet buyers to buy things from online shops. Customers can request money from their bank account, attach it to a credit card, or use a prepaid debit card to make an online purchase, thus creating a digital payment. Payment gateways are essential because they make it easier for customers to pay for goods.

How can you increase the security of your payment system?

Payment authorization and processing are necessary for a transaction to be legitimate. Considering that some vendors overcharge for legitimate transactions, a business owner should never sign a purchase order without first verifying its validity. Ensure the vendor has a solid reputation and can offer evidence that the order is legitimate before placing an order. In our digitally evolved culture, data breaches are already frequent. No organization is safe from the nefarious actions of hackers who aim to hack into businesses to steal vital consumer data, whether big corporations or tiny companies. If you own an online business, keep in mind your payment channel is more protected and encoded so that customers can recognize you. Payment risk management can reduce payment processing fraud. Online payment acceptance is getting more and more challenging as online shopping grows in popularity. By utilizing a Secure Payment Gateway service, your company can be shielded from financial theft and damage by cybercrime.

Featured Post

DL Mining Launches Ethereum Contract Participation Service, Helping Users Earn $2K Stable Daily Returns

Zizo Gala-Mkhize-

October 20, 2025

Soapie Teasers

Sister Sites

Most Popular

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

Popular posts

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

A Wood-Burning Stove in a Tent: A Guide to Safe Hot Tenting

April 08, 2021

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Footer Menu Widget

Created By Blogspot Theme | Distributed By Gooyaabi Templates

Social Plugin