Ad Code

Translate

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Smart strategies for trading on crypto exchanges

October 20, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

Discover Honeybee Pharmacy (2025 Guide Important Consumer Tips)

October 14, 2025

Posture Bra: Improving Back Support and Comfort

October 20, 2025

How To Find Suitable Properties In Cyprus?

October 20, 2025

10 Effective Strategies to Improve Domain Authority of Your Website

October 20, 2025

Planning a facelift of your home? Loans can tackle financial side

Khabza Mkhize

February 11, 2024

The only place in the world where you can retard after a long, hectic, and tiring day. No matter how much luxury you can afford while on a vacation, home calls you afterr some tim,. Nothing is cozier than your bed; nothing is brighter than the window that reflects the sun's shine in your living room.

The aroma that your kitchen releases is the only tool to feed your soul that sometimes feels nostalgic. After wearing many identities of an executive, a multinational company CEO, or a perfect man/woman in the world outside, you can finally ‘be yourself’ at home.

The aroma that your kitchen releases is the only tool to feed your soul that sometimes feels nostalgic. After wearing many identities of an executive, a multinational company CEO, or a perfect man/woman in the world outside, you can finally ‘be yourself’ at home.

If a place is so important, how can you not think about its well-being. ? In the exchange of care your abode gives, it asks only for graceful treatment and proper maintenance. A home improvement can pour freshness into your place and stay younger for longer.

Home improvement loans are in abundance when it comes to loan offers. According to the applicants' affordability, they are available with tailored deals. The best part is that their online existence makes them easier to access.

Things to consider before applying for loans for home improvement

With a considerable amount of investment, it is good to plan everything systematically. Here are a few points that should come in mind before applying for the loan.

Do you want partial improvement or complete?

Do you want to improve only a part of your place or complete home? Decide it NOW. Financial assistance is available for both purposes. This helps determine the cost, and then funds can be borrowed accordingly. Remember, you must return every borrowed penny from the lender, and every step should be captious.

Choose wisely the type of loan.

Several types of loans for home improvement are available according to the purpose. For instance –LOANS FOR

- Kitchen improvement

- Loft conversion

- Exterior paint

- new conservatory, outside decking, or add a garage

- Bathroom Renovation

- Garden renovation

- Backyard makeover

There are many alternatives; make sure that the option is wise and rational.

Features that the loan deal should contain

Varied lenders provide funds with varied features; however, certain things should generally come. These are –

Quick access to funds through instant approval decision

Delays can increase the cost of home improvement as the construction material prices keep changing. The online lender you choose should have the feature of instant approval decision. Timely availability of funds is necessary to do things according to the plan. Besides, family members can't delay their daily routine for long. Fast funds can short time the work done faster.No unethical charges or fees, like - upfront fee

It is essential to see that in haste to get money, the fake lenders fail to strengthen their trap. The lending company in your priority should have a different upfront fee condition. Also, the habit of taking extra charges or hiddeefeeses is something other than something that comes with ethical lending.Options without prepayment penalty are better.

If you want to pay off the loan nearly during the loan tenure, a prepayment penalty can be an extra expense. Find a lender that does not take any such fee and allows paying off the loan (before completion of tenure) free of cost. Such choices are relatively easy to find as, due to excessive completion, many lenders have this feature.Do not forget to use the loan calculator.

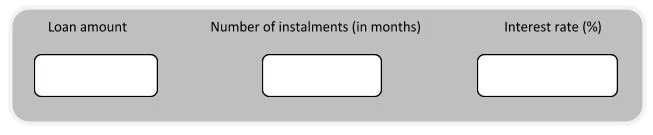

It is excellent to get an idea beforehand of the total cost and the monthly installments of the loan. Budgeting becomes easy, and you can see how much adjustment is required to add the new repayments.A loan calculator provides loan quotes, and then the decision to borrow becomes easy. If costs look higher, switch to the other option; otherwise, stay.

You need to fill in the following details to get the quote.

Avoid these mistakes while applying.

The funds are available online, but your application must be flawless to get them smoothly. Following are some of the common mistakes that most applicants make while applying for a loan. Read them and don’t do them in your case.Multiple applications to varied lenders

In a hurry to get funds faster and to prevent the anxiety of rejection, applicants apply to many lenders such as British Lenders, A one Loans, The Easy Loans, etc. Oops! It is a mistake. Applying for funds to many loan companies simultaneously makes your application more prone to rejection. Multiple applications bring many search footprints due to credit checks performed on your credit file. This makes the applicant look credit-hungry, and the lenders act reluctant and may even reject the application. Never do this, and apply to only one lender at a time.Not staying loyal to the lender.

I think there are few other options, as the lenders may want to know why you left the last one and then may raise doubt about your affordability. Why not keep a focused mind and find a lender you can rely on and then stick to it. Stay loyal to the lender and cooperate in every possible way. Give due response to calls and provide every necessary financial detail.Home improvement can make your home the best place to return at the end of the day. Borrow funds but wisely and take only the required amount to prevent any money mess later. Wise financial decisions bring happiness at home, and it feels like the whole world is smiling.

INFOGRAPHIC

- 5 points act decisive in home improvement loans

- What is your credit score performance?

- Is the loan secured or unsecured?

- How much amount do you want to borrow?

- What is your preferred repayment plan?

Description – Home improvement loans make the comeback of life and liveliness easier. Borrow funds online and revive the ‘feel at home’ feel with an absolutely new look of your house.

Featured Post

DL Mining Launches Ethereum Contract Participation Service, Helping Users Earn $2K Stable Daily Returns

Zizo Gala-Mkhize-

October 20, 2025

Soapie Teasers

Sister Sites

Most Popular

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

A Wood-Burning Stove in a Tent: A Guide to Safe Hot Tenting

April 08, 2021

Five Do’s For a Healthy Turnover That Bolsters Talent-Retention

October 20, 2025

Popular posts

List of 6,000+ Dofollow Commentluv Blogs FREE (Updated 2025)

January 16, 2025

What is Ozempic (semaglutide)? (Updated in 2025)

January 30, 2025

A Wood-Burning Stove in a Tent: A Guide to Safe Hot Tenting

April 08, 2021

Footer Menu Widget

Created By Blogspot Theme | Distributed By Gooyaabi Templates

Social Plugin